arizona solar panel tax credit

An individual or corporate income tax credit is available for taxpayers who own a qualified energy generator that first produces electricity before Jan. The credit amount allowed against the taxpayers personal income tax is.

Arizona Solar Incentives And Rebates 2022 Solar Metric

The Residential Arizona Solar Tax Credit offers a 25 credit up to 1000 off your personal state income tax.

. As a credit you take the amount directly off your tax payment rather than as. The Arizona income tax credit for solar panels is 25 of your systems installed costs or 1000 whichever amount is less. For example if your solar PV system installed in 2022 cost 18000 and your utility gave you a one-time rebate of 1000 for installing the system your tax credit would be calculated as.

Arizona State Residential Solar Tax Credit. Provide heating provide cooling produce electrical power produce mechanical power provide solar daylighting or. When you purchase your system the Residential Arizona Solar Tax Credit takes what you will initially pay for your panels and returns a fraction of the total system price.

Starting in 2020 the value of the tax credit will step down to 26 and then. Owners of new residential and commercial solar can deduct 22 percent of the cost of the system from their taxes. 6 rows Solar energy systems in Arizona get a tax credit equivalent to 25 of their value or 1000.

This benefit allows eligible homeowners to reduce the. This incentive is an Arizona personal tax credit. Provide any combination of the above by means of.

Arizona Residential Solar Energy Tax Credit Buy new solar panels in Arizona and get a 25 credit of its total cost against your personal income taxes owed in that year. Arizona State Residential Solar Tax Credit. This is a personal solar tax credit that reimburses you 5 of the cost of your.

Most homeowners in the Grand Canyon State are eligible for the state solar tax credit. Owners of new commercial solar. The 30 tax credit applies as long as the home solar system is installed by December 31 2019.

Arizona Solar Tax Credit In addition to the federal ITC the State of Arizona offers an income tax credit. Residential Arizona solar tax credit. It provides a 26 tax credit toward the cost of a solar panel system.

The Arizona State Residential Solar Tax Credit provides a credit for 25 of the solar system cost with a 1000 maximum. Arizona solar tax credit Every resident in Arizona who installs solar panels gets a state tax credit of 25 of the total system cost up to 1000 to be used toward State income taxes. You can claim this solar tax credit when you file your yearly federal tax return.

The Residential Arizona Solar Tax Credit reimburses you 25 percent of the cost of your solar panels up to 1000 right off of your personal income tax in. 1 2021 using a qualified energy resource. The most significant solar rebate offered in Arizona is the Credit for Solar Energy Devices from the Arizona Department of Revenue.

Arizona Residential Solar and Wind Energy Systems Tax Credit. The tax credit will drop to 22 on January 1 2023 and is expected to go away completely at the end of that. This is for 25 of the cost of your system with a cap of 1000.

6 The maximum credit in. Most Arizona residents are eligible to receive the Federal Solar Tax Credit also called the Residential Clean Energy Credit. Arizona state tax credit for solar.

Residential Arizona Solar Tax Credit. Arizona State Energy Tax Credits Arizona offers state solar tax credits -- 25 of the total system cost up to 1000. State Income Tax Credit in Arizona.

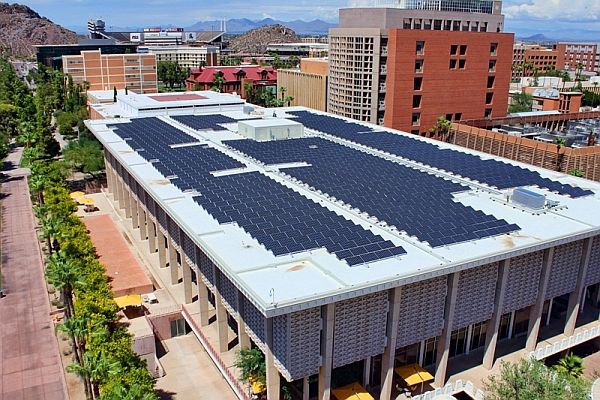

Arizona is a leading state in the national solar power. This credit provides a state tax deduction equal. This is valid for the year.

Arizona Solar Incentives Tax Credits And Rebates

2022 Solar Incentives And Rebates Top 10 Ranked States

Thinking About Solar Tucson Electric Power

Democrats Push Tax Credits To Bolster Clean Energy The Hill

New England Solar Power A Guide To Solar Energy In These 6 States Cnet

Arizona Solar Overview Az Solar Tax Credit Rebates And Incentives

Arizona Solar Tax Credit And Solar Incentives 2022 Guide

Five Reasons To Go Solar In Arizona Prometheus Solar

Solar Incentives For Arizona Residents Tax Rebates For Solar Energy Arizona

Is Solar Energy Expensive Energy Solution Providers Az

Solar Current Events Archives Solar Solution Az

How To Take Advantage Of Solar Tax Credits Earth911

Arizona Solar Tax Credits And Incentives Guide 2022

Are Solar Panels Worth It 10 Things To Consider Before Installing

2022 Arizona Solar Incentives Guide Tax Credits Rebates More

Biden Seeks 10 Year Extension Of Solar Tax Credit New Clean Energy Standard Reuters Events Renewables

Phoenix Solar Incentives Total Solutions

Solar Incentives Arizona Solar Incentives Federal Solar Incentives